How Credit Scores Really Work and How to Fix Yours for Free

A bad credit score can quietly cost you thousands of dollars a year.

For example, someone with a low score might pay $50,000 more in interest over the life of a mortgage compared to someone with excellent credit. In the U.S., poor credit can also mean paying 76% more for car insurance, and in some countries, it can even block you from renting an apartment or getting certain jobs.

Despite these huge consequences, millions of people still don't fully understand what drives their score, or how to fix it without spending a single cent.

In this guide, you'll discover exactly how credit scores work, the myths that cost people money, the best free tools to check your score, fast ways to improve it in 30 days, and how to correct costly errors on your credit report.

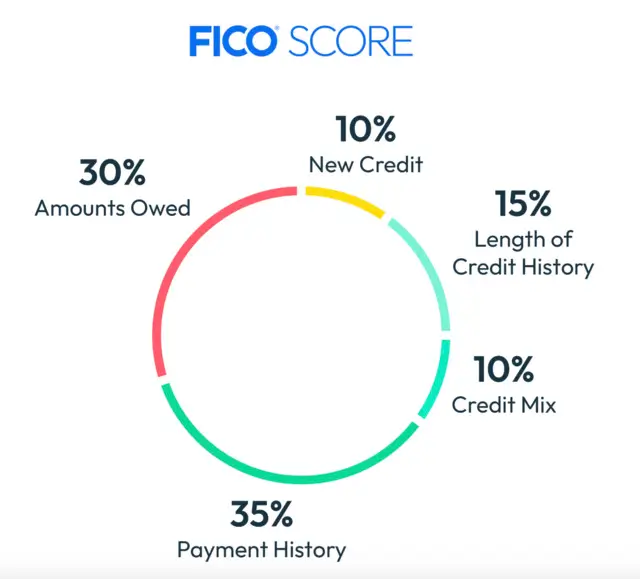

What Makes Up Your Credit Score in the Finance Industry

Before you can improve your score, it is essential to know how it is calculated. Credit scores are determined using your financial history, and the two most widely used models are FICO and VantageScore. Banks, credit card companies, and lenders rely on these numbers to assess how reliable you are as a borrower.

The key factors that influence your score include:

Payment history – Whether you pay your bills on time.

Credit utilization – How much of your available credit you use compared to your total limit.

Credit age – How long you have had credit accounts open.

Credit mix – A variety of accounts, such as credit cards, loans, and mortgages.

New credit inquiries – Recent applications for new credit.

Image Credits: https://www.myfico.com/credit-education/whats-in-your-credit-score

Although both FICO and VantageScore use a range from 300 to 850, they may weigh these factors slightly differently. Understanding these components is the first step toward managing and improving your score effectively.

Common Credit Score Myths in Consumer Finance

Once you understand how scores are built, it is important to clear up some common misconceptions. The wrong information can lead to poor financial decisions that hurt your score.

One myth is that checking your own credit score will lower it. This is false. When you check your score through a reputable service, it is considered a soft inquiry and has no effect on your score. Only hard inquiries, such as applying for a loan, can cause a small and temporary dip.

Another misconception is that carrying some debt improves your score. Debt itself does not help. What matters is demonstrating that you can manage credit responsibly through on-time payments and keeping balances low.

Finally, some believe that closing old accounts will boost their score. In reality, this can shorten your credit history and may reduce your score instead of improving it.

How to Check Your Credit Score for Free Using Trusted Finance Apps

Monitoring your credit score regularly allows you to spot changes quickly and take action before problems grow. You do not need to pay for this service, as several reliable platforms provide it at no cost.

Popular options include:

Credit Karma – Offers weekly updates, credit monitoring, and personalized tips.

Experian – Provides access to your Experian credit report and sends alerts about changes.

ClearScore – Widely used in the UK and other countries, with clear and simple reports.

By checking your score each month, you can track your progress and identify issues early, giving you more control over your financial health.

Easy Ways to Boost Your Credit Score Quickly with Finance Tips

If you are looking for faster improvements, certain strategies can deliver results in as little as 30 days. These changes are practical, realistic, and require no expensive services.

Reduce your credit utilization by keeping your balances under 30% of your total limit. If possible, pay down balances before your statement date so a lower figure is reported to the credit bureaus.

Set reminders to ensure every payment is made on time, as payment history has the largest influence on your score.

Consider becoming an authorized user on a trusted family member's account. Their positive history can be added to your report and help raise your score.

Another approach is to request a higher credit limit from your issuer. If approved, your utilization ratio decreases, which improves your credit score even if your spending stays the same.

How to Fix Errors on Your Credit Report with the Credit Repair Process

Mistakes in your credit report can cause unnecessary damage to your score, but these errors can be corrected for free. Common issues include accounts you never opened, incorrect balances, or inaccurate payment dates.

To fix them, start by obtaining your credit report. In the United States, you can get a free copy from AnnualCreditReport.com. Review the report carefully for any inaccuracies.

If you find an error, file a dispute with the credit bureau. Most have online forms where you can submit details and supporting documents. Once submitted, the bureau must investigate and respond within 30 days. If the error is confirmed, your report will be corrected.

This process is straightforward and does not require hiring a credit repair company.

Final Thoughts on Taking Your Credit Score Seriously

Your credit score influences many areas of life, from securing housing to getting the best interest rates on loans and credit cards. That is why it is worth checking your score today and seeing where you stand. If you are already in a healthy range, maintain your good habits. If not, start applying the strategies in this guide right away. The earlier you take action, the sooner you can see positive results.

Frequently Asked Questions About Credit Scores

1. How often should I check my credit score?

Check at least once a month using a free credit monitoring tool. This helps you track changes and detect problems early.

2. Will paying off all my debt instantly improve my score?

It may help, but the effect depends on factors like your payment history and account age. Improvements often appear gradually over a few months.

3. Is there such a thing as a perfect credit score?

The highest possible FICO score is 850, but anything above 760 is considered excellent and qualifies you for the best offers.

4. Can I build credit without using a credit card?

Yes. Paying other loans on time also builds credit, and some services report rent or utility payments to the credit bureaus.

5. Do all countries use the same credit scoring system?

No. Some countries have different ways to assess creditworthiness, but keeping a good payment history is a universal principle.

More Popular Reports

More Popular Reports

-

Outsmart Inflation in 2025 Without Sacrificing Your Lifestyleinflation-proof money strategies 2025 best fintech apps for saving cashback tools for smart shopping beginner investment apps 2025 how to fight inflation without cutting back automate savings apps

Outsmart Inflation in 2025 Without Sacrificing Your Lifestyleinflation-proof money strategies 2025 best fintech apps for saving cashback tools for smart shopping beginner investment apps 2025 how to fight inflation without cutting back automate savings apps -

5 Free AI Job Search Tools That'll Get You Hired Faster, Even With Zero Experienceai job search resume builder ai interview ai prep free job tools usa jobscan alternative remote job tips

5 Free AI Job Search Tools That'll Get You Hired Faster, Even With Zero Experienceai job search resume builder ai interview ai prep free job tools usa jobscan alternative remote job tips

Instagram

Instagram

Share

Share